Explaining REInsurePro’s Role to Investor Clients

REInsurePro’s Program is unique, and as such, we understand that it may be challenging for your investor clients to understand what our role is in insuring their properties. The outline

Customizable Insurance Designed for Artisan and General Contractors

Commercial General Liability: $1MM per occurrence/$2MM annual aggregate

Workers’ Compensation: up to $1MM/$1MM/$1MM

Inland Marine for tools and equipment: Unscheduled up to $10,000 or scheduled options available

Contractor Bonds: License, Permit, and Dishonesty

Excess Liability: Up to $5MM available for certain classes

Contractor’s Pollution Liability (not available on all policies): Limit options from $500,000/$500,000 to $2MM/$2MM

1.

One-stop shop for contractor coverage

2.

Obtain multiple lines with one submission

3.

Admitted & non-admitted options available

4.

Fast proposal turnaround

5.

Expert underwriting and support

6.

Excellent claims service with 24/7 reporting

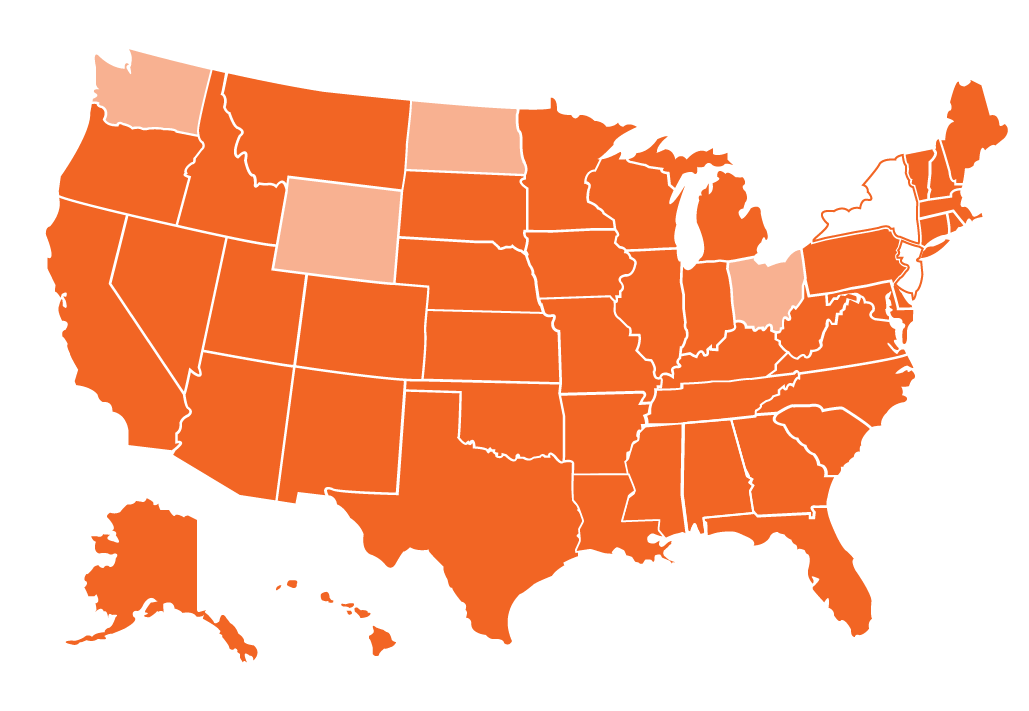

*Workers’ Compensation Not Available In Monopolistic States:

Completed ACORD forms 125 & 126 required to bind

Completed contractors supplemental application (paper or online) – Download here

New Ventures:

General Contractors:

Subcontractors

Loss Runs

Applications

To speak to someone about class-specific eligibility, call Seth Markum at 816-398-4058.

Nebraska

Texas

Oklahoma

Missouri

Montana

Mississippi

Pennsylvania

REInsurePro’s Program is unique, and as such, we understand that it may be challenging for your investor clients to understand what our role is in insuring their properties. The outline

What billing options are available? Direct Bill Monthly- The insured provides a credit card or ACH account to be charged for the first month on binding, then on the same

Real Estate Investing (REI) is by nature, a profession dependent upon relationships. Think about all the people your investor clients interact with in just one acquisition: sellers, the sellers’ agent,

Copyright © 2024 REInsurePro. All Rights Reserved.

A division of National Real Estate Insurance Group.

Fill out this online form for a submission that:

A complete submission by email should include: