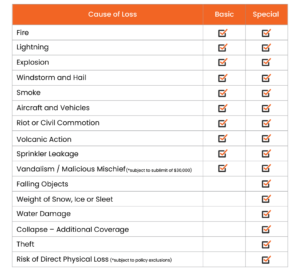

It is commonly assumed that water damage resulting from a burst pipe is covered under all policies. However, Water Damage as a result of a burst pipe is NOT covered under Basic Form coverage, only Broad and Special Form. REInsurePro, like most other insurance programs, only offers Basic or Special Form coverage.

Basic vs Special Form Coverage Compared

*Risk of Direct Physical Loss above refers to any peril not listed on the chart. In the Special Form, unless a peril is listed as an exclusion within the policy, there is coverage. This is referred to as “Open Perils.” However, with both Basic and Broad form coverage, a peril must be listed within the policy for there to be coverage.

Even if an investor has Water Damage coverage…

Water Damage must be “sudden and accidental” to be covered. Examples include a pipe bursting or the accidental overflow of a bathtub. If freezing causes a pipe to burst, one must certify that they have done their best to maintain heat in the building or have fully drained the system and shut off the water supply in order for coverage to be available. If rain damaged the interior of a property after the roof had been compromised by a storm, Water Damage coverage would apply. Damage over time, such as a slow leak that causes mold behind the walls may not be covered, depending upon how long the condition has been left to develop. Investors should report any issues to their insurer in a timely manner.

How does “Water Damage” differ from a “Flood”?

A flood may occur when water from a natural source breaches its banks during heavy rains. A flood may also occur when the ground is over-saturated with water, causing the excess to seep through foundations or other vulnerable parts of the structure. One of the key components of a flood is “rising waters” from a natural source. It is important to note: Flood coverage is never part of Basic, Broad or Special Form coverages– it is set up as a “stand-alone” policy and may be purchased separately.

What about “sewer backup”? Is that covered under Water Damage or Flooding?

Sewer backup is another common exclusion in property policies. Sewer backup is defined as “water that backs up or overflows from a sewer, drain or sump.” So, what many people refer to as a “flooded basement” may or may not technically be “flooded” when it comes to insurance – it all depends on how the water enters the dwelling. That stated, investors will want to make sure that any drainage systems in basements are well-maintained, and sump pumps are regularly tested to help avoid water damage from sewer backup. Though a sewer back-up involves plumbing, it is a separate peril on its own and limited coverage may or may not be available, depending upon the insurer.

Adding Water Damage Coverage

By purchasing Special Form coverage, your investor clients can make sure they have coverage for water damage. Special Form does cost more than Basic Form, but Special Form covers significantly more than Basic. Investors should be aware that often only Basic Form is available for vacant properties, which is why protecting them against frozen pipes is so important!

What does the technical lingo for this exclusion look like in the investor client’s policy?

Sample policy language may look like this:

“We will not pay for the loss or damage caused directly or indirectly by…Water:

- Flood, surface water, waves (including tidal wave and tsunami), tides, tidal water, overflow of any body of water, or spray from any of these, all whether or not driven by wind (including storm surge);

- Mudslide or mudflow;

- Water that backs up or overflows or is otherwise discharged from a sewer, drain, sump, sump pump or related equipment;

- Water under the ground surface pressing on, or flowing or seeping through:

- Foundations, walls, floors, or paved surfaces;

- Basements, whether paved or not; or

- Doors, windows, or other openings; or

- Waterborne material carried or otherwise moved by any of the water referred to in Paragraph 1, 3 or 4, or material carried or otherwise moved by mudslide or mudflow.

This exclusion applies regardless of whether any of the above, in Paragraphs 1 through 5, is caused by an act of nature or is otherwise caused. An example of a situation to which this exclusion applies is the situation where a dam, levee, seawall, or other boundary or containment system falls in whole or in part, for any reason, to contain the water.”

As insurance policies may vary, investors should check their own policy for language specific to covered properties.

What can burst pipe damage cost the investor client?

Water damage losses can vary from a few hundred dollars to tens of thousands depending upon the extent of the leak or intrusion. Let’s put it this way, 40,000 gallons of water (that’s the size of a small water silo) can pour through your client’s investment property in no time, and prolonged moisture can cause catastrophic mold damage if not attended to within 24-48 hours. If you have investor clients who own a multi-unit property, adjacent units could also become “casualties of war”. Your investor clients could even be held liable for water that flows into their neighbor’s property.

How can investors protect themselves?

First, investors should know what is in their policy: Investors should read the sections of their insurance policy that address water damage. It is important to know both what they are and are not covered for. If you or your investor client have questions, don’t hesitate to ask your sales manager, who would be happy to help you!

Shut the water off and drain the systems at all vacant properties: At the very least, the investor should shut the water supply off in the vacant house itself. That way, if a pipe does burst, the amount of water will be limited to what is currently in the plumbing system. Better still, the investor should shut off the supply at the street and drain the system. Then, there isn’t any water in there to freeze in the first place. Pouring environmentally safe, biodegradable antifreeze into toilet bowls/tanks, sinks, and any other drains in the house can keep those from being damaged too. If your investor client doesn’t feel comfortable doing this themselves, winterization is a relatively simple job for a professional. Also, the heat should not be set any lower than 55 degrees. It may need to be higher during extreme cold snaps or if the property is in a more northern location.

For occupied properties, insulate pipes that are on an outside wall: Before the temps drop too low, investors should make sure any plumbing located on exterior walls are properly insulated. Your investor client should also inform tenants to keep faucets on a slow drip during cold snaps and open cabinets below sinks to allow warmer air to circulate. Text or e-mail reminders are great! Lastly, technology can be a great ally – there are a variety of companies out there offering freeze sensors that send alerts if there is an issue.

About that mold: Mold can grow within 24-48 hours after a water event like a burst pipe. Adding heat to the equation will only make it worse. As such, it is imperative after a storm to dry out properties as quickly as possible. Your investor client may need to call in a water mitigation company to help if the job is too large. Mold is typically excluded from most property policies, so swift action to remediate any mold issue is critical!

Sump Pumps: Investors will want to make sure their sump has a back-up battery in case of a power outage. Excessive rain, downed trees, and other plant debris back up city drains, causing additional drainage issues. If there is a catastrophic flood, there may be nothing your investor client can do but keeping their sump hummin’.

Investors should make sure their tenant understands that their personal property isn’t covered: Investors will want to include a clause in the lease requiring tenants to carry renters insurance – and make sure to enforce it. Tenants should be aware that any insurance the investor carries on the property does not apply to tenant’s personal belongings. Stress the importance of reporting any hazardous conditions on the property to the investor or the property manager immediately. It may be beneficial for investors to include a section in the lease where the tenant acknowledges their understanding of these items. Another option is to purchase a product like our Tenant Protector Plan that does provide contents coverage for tenants.