Is It Covered? Flood

The term “flood” is used quite liberally in everyday language. Is water backing up in your investor client’s basement? They may tell you, “The basement flooded.” But did it really, […]

Evaluating Flood Insurance Options

It is important that property owners understand their risk exposure to flood AND are aware that their property insurance policy most likely does not include this coverage. There are several options available to your clients for flood insurance, so read on to help them understand how to evaluate their risk and work to determine the right course of action for them.

Is It Covered? Sewer Backup

Many property owners think they automatically have coverage for Sewer Backup at their investment property. However, most homeowners and business insurance policies do not cover Sewer Backup unless it is […]

Preparing Investment Properties for Severe Spring and Summer Weather

The weather is warming up and now is great time to help your clients prepare for upcoming risks that come with spring and summer weather. It may be surprising how much advance planning is necessary. Thunderstorms, flooding and tornadoes are approaching, so how can you relay the importance of this preparedness to your investors and clients?

Is It Covered? Burst Pipes

It is commonly assumed that water damage resulting from a burst pipe is covered under all policies. However, Water Damage as a result of a burst pipe is NOT covered […]

Three Types of Coverage Triggered by Windstorms

The 2022 Atlantic hurricane season (officially beginning June 1), is predicted to be another active one calling for 19 named storms. This increase continues the trends from 2020 and 2021 of above average activity. If your investor clients own Atlantic coastal properties, now is the critical time to be sure they have the appropriate coverage they need should one or more of these forecasted storms strike.

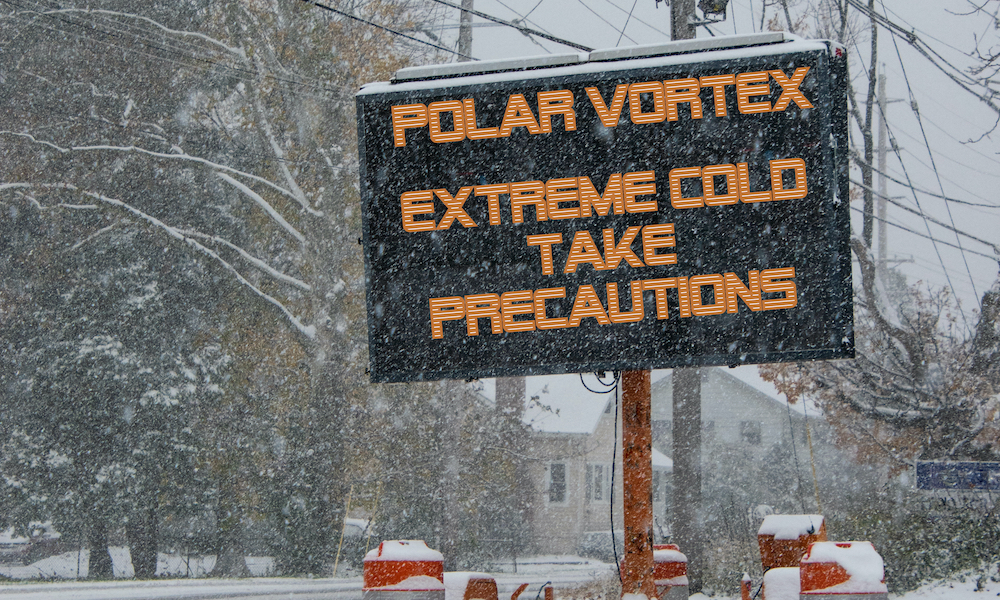

Shield Investment Properties from Winter Risk, Pt 2

Winter has made its presence known, but your investor clients can still fortify their “castles” against the cold. The saying “better late than never” holds true here. In this two-part article series, we are looking at four winter perils from which your clients need to shield their properties. In Part 1, we addressed ways to protect occupied properties and this time, we’ll cover vacant properties and renovation projects.

2021 Loss Events in Review

The year 2021 continued to be an interesting year in the insurance market, with extreme and unique weather events and ongoing uncertainty around COVID. The industry as a whole continues to experience a rapidly hardening property market, a trend that accelerated in 2020, but had been snowballing the previous five or six years. It is common for the market to cycle from hard to soft every five to ten years, so it is increasingly important for investors to ensure that their insurance agent is advising them on ways to “ride out the storm” while still maintaining adequate coverage.

Reduce Risk of Mold After a Flood

With many parts of the country experiencing significant flooding this spring and summer, we wanted to share some tips on how to reduce the risk of mold after a flooding event. If not caught within 24-48 hours, you can have a serious mold problem on your hands. Share these tips with your investors to help keep their property mold-free after a heavy rain event.

Knowing the Difference Between Flood, Water Damage, & Sewer Backup

Helping your investor clients understand the difference between Flood, Water Damage and Sewer Back-Up is a common challenge. Which covers what exposure? How can your client purchase these coverages if they are excluded from their current policy?