There are plenty of resources to help homeowners get their families and their homes ready for a potential natural disaster. However, real estate investors have some unique challenges in readying a property that they own, but don’t inhabit. Let’s discuss some of the ways investors can keep their investments protected and prevent injuries from natural disasters.

Helping Tenants

As mentioned above, one of the most unique aspects of disaster preparation for real estate investor is that they do not live in the property they are trying to protect. If your investor clients have rental properties, they or the property manager will need to be prepared to contact tenants and vice versa should there be an emergency. Ask you investor clients: Do your tenants have a reliable emergency contact? Is that contact prepared to respond if they get a call? In this situation, sometimes helping a tenant simply means pointing them to reliable resources like the Red Cross or FEMA.

Another important question for your investor clients to consider: What expectations do you have for your tenants to protect the property in the event of an emergency? A tenant’s primary focus during a weather event will be their own family and possessions, so investors should ensure they or the property manager are prepared to act swiftly to protect the property. If your investor clients do have any expectations of their tenants, those expectations must be communicated to them well in advance, such as through the lease.

Preparing Tenants & the Investment Property for Weather Risks

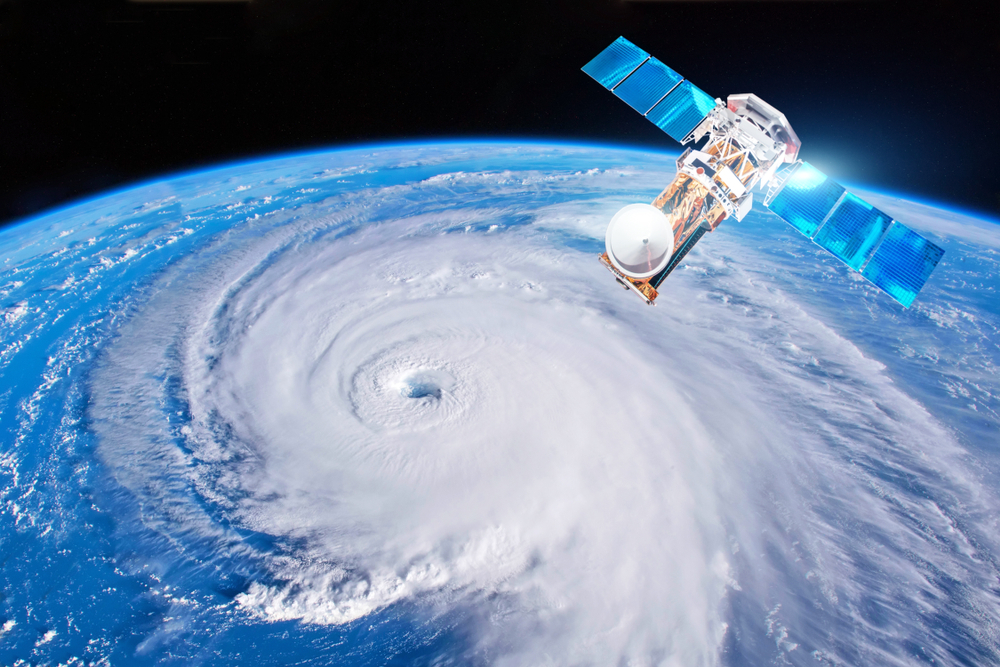

The first step your investor clients should take in preparing for natural disasters is to become familiar with the specific types of danger the property or tenants could encounter. This danger of course differs according to each climate in the United States. The four major weather conditions that may put the investor’s property and its inhabitants at risk are floods, hurricanes, wildfires, and tornadoes.

Floods

Many people think flooding may only affect them if they live on a flood plain; although, flash flooding can affect almost any property in the U.S. if enough rain falls within a short window of time or for several days in a row. Finding out a property’s Flood Zone can help investors determine their general flood risk. Although, investors should consider adding Flood coverage to their insurance strategy even if the location is at a lower risk for flood. Remind your investor clients that Flood coverage is always purchased separately from property coverage and if going through the National Flood Insurance Program there is usually a 30-day waiting period for Flood coverage to go into effect.

Though investors may be able to avoid some water damage by utilizing sandbags, being prepared for mitigating losses after a flood is very important. Here are some tips from FEMA to help your investor clients or their property manager remain safe when assessing damages after a flood:

- Return to inspect the property only when authorities say it’s safe. Watch for downed power lines as they can electrically charge the water.

- Wear boots and heavy gloves during clean up– snakes and other animals may be in the house.

- Do not touch electrical equipment if it is wet or if you are standing in water. If safe to do so, turn off the electricity to prevent electric shock.

- Only use generators or other gas-powered machinery outdoors and away from windows.

Resource for tenants: Be Prepared for a Flood Handout – FEMA

Hurricanes

For coastal locations, tropical storms and hurricanes are the main concern when it comes to natural disasters. While investors and their tenants may have several days to get ready for an approaching tropical storm, it is still wise to be prepared well in advance as some supplies, like plywood for boarding up windows, may sell out quickly. Investors should double-check their insurance coverage far in advance too. Named Storm coverage is often excluded from standard property policies and must be purchased separately. In addition to having board-up materials on hand and the proper insurance, investors will also want to:

- Make sure all trees and shrubs are well-trimmed to make them more wind resistant.

- Secure any loose gutters or downspouts and clear any clogged areas to prevent water damage.

- Be sure the battery backup for the sump pump is in good working order to prevent drain backups.

- Purchase a portable generator for use during power outages. NEVER try to power the house wiring by plugging a generator into a wall outlet.

Read “Hurricane Preparation Tips” for a more comprehensive look at hurricane damage and injury prevention.

Wildfires

Your clients investing in California or any of the other western states have already had a few challenging years when it comes to wildfire. The best thing investors can do to protect their investment against a wildfire is to create “defensible space.” This includes activities such as:

- Frequently clearing dead vegetation, dried leaves, pine needles, and ground debris from around the home.

- Removing all tree limbs within 10 feet of the chimney, or that overhang the roof.

- Creating fuel breaks with driveways, walkways/paths, patios, and decks.

- Creating at least 12 feet of space between canopy tops for trees 30 to 60 feet from the home.

- Making sure entry points into the home are guarded, for example, vents should be covered with mesh screen

Though tenants may have some responsibilities regarding lawn maintenance, no one will be more concerned about protecting the investment property from wildfire than the investor. Therefore, your investor clients should make sure they or the property manager have a detailed plan for the upkeep of the property’s defensible space. To keep tenants safe, investors must emphasize the importance of following any evacuation orders given by local authorities. Fire moves fast, so it is best to simply get out! Read Wildfire Preparation to learn more.

Tornadoes

Tornadoes most often occur in the spring and summer months but can strike in any season and at all hours of the day. There are some areas of the country that are more prone to tornadoes, namely the Midwestern and Southeastern states. Though a property may be built to code, that doesn’t mean it can withstand winds from these extreme wind events. For this reason, building a “safe room” to FEMA or ICC 500 standards can provide a space where tenants can seek refuge during a tornadic event. Good places for safe rooms are:

- The basement.

- Atop a concrete slab-on-grade foundation or garage floor.

- In an interior room on the first floor.

In addition to having a safe room, keeping up on tree maintenance by trimming dead limbs or removing a dead tree can keep flying debris from damaging the main structure. Your investor clients should also instruct tenants to bring any outdoor furniture, deck, or yard decorations inside if severe weather is in the forecast.

Resource for tenants: Be Prepared for a Tornado Handout – FEMA

Learn more about post-storm mitigation here.

Encourage Investor Clients to Review Their Insurance Coverage

Investors shouldn’t wait until severe weather is headed their way (or after a storm) to become familiar with their insurance coverage. There are certain coverages that aren’t typically included in standard property policies, such as Named Storm coverage and Flood coverage. An investor discovering that they do not have coverage for the devastating losses natural disasters can bring can exponentially increase hardship, if not take them out of business altogether.

To read more on Named Storm or Flood coverage check out “Is It Covered? – Named Storm” and “Is It Covered? – Flood.”

It is also important for investors to know their responsibilities as an insured. Though it may be challenging to gather all the details at first, reporting losses as timely as possible can help expedite the claims process. Let your investor clients know that you are able to help with any questions!

Resource for tenants: Print-Ready Home Inventory Form – NAIC

Everyday Preparedness

Whether or not your clients invest in areas prone to natural disasters, they should be practicing “everyday preparedness.” Smaller emergencies like a water heater replacement may be unavoidable, and items like carpet may need to be replaced due to wear-and-tear, but there are many losses that can be avoided through routine maintenance. Checklists like the Spring Maintenance Checklist can give investors a framework for making a more robust seasonal maintenance routine. Also, investors should not just assume their property manager has every base covered, they should be aware of the specific services they perform. Property managers should also communicate regularly with investors about any inspections or repairs they perform.

Of course, one of the best ways to safeguard rental properties is to place the best tenants possible. However, even good tenants can benefit from a reminder or two about living safely in their home. For example, cooking fires are one of the deadliest, but most preventable accidents. Safe living practices such as attentive cooking, proper use of space heaters, and proper training on the use of smoke detectors and fire extinguishers can help reduce the risk of unnecessary damage to investment properties and prevent severe injuries, or even save a life.

Resources from FEMA & Apps

Even if your clients invest in mild climates, a preparedness mindset can help them in many areas of their investing life- from financing, to purchase, to exit strategy. The following apps can help in disaster preparedness, survival, and recovery:

- FEMA Mobile App – Real-time alerts, Emergency Safety Tips, Emergency Shelters, Disaster Recovery Centers

- Red Cross Apps – First Aid, Pet First Aid, Emergency, Tornado, Hurricane, Earthquake, Flood, and more!

- National Association of Insurance Commissioners Home Inventory App – Create a home inventory for an easier claims process